Summary

Elon Musk claimed on X that he eliminated the IRS team responsible for the “Direct File” program, which allows Americans to file taxes online for free.

His statement was in response to a right-wing MAGA influencer who called the “direct file” tax program a “far-left government-wide computer office” built by Elizabeth Warren.

Thus far, the website remains active.

OpenSecrets, 02/06/2024 - “TurboTax maker Intuit spent millions in record lobbying blitz amid threats to tax prep industry”

This is the great sell-off of America. Anyone who knows what happened to Russia over the course of the 2000s know what’s coming is not good.

Who the fuck do these people think they are. Unelected, unsanctioned, no transparency, no procedure, no committees, no votes, no oversight, no laws. Just the whims of a tech billionaire and his cronies and a President who has given him the run of Washington to rip up what he pleases. If there is any justice, both of these fucks will be dealt with harshly.

Just the whims of a tech billionaire

And Afrikaner racist. That was the group of people that literally ran a white supremist government in South Africa for 80 years and jailed Nelson Mandela for over 30 years.

Kings. They think they’re kings.

They are kings. No one is going to stop them

literally look into peter thiel’s whole belief system

If there is any justice, both of these fucks will be dealt with harshly.

I mean, if the past four years of waiting on consequences for Trump is any indication…

“unelected”

They kinda were though, Trump didn’t hide the fact that that’s what he wanted to do and that’s what people voted for.

Disagree. They may have voted for, among other things, Elon to be put in a position to review spending and attempt to shore it up. They did not vote for him to be given free reign over all of the basic structures of government to fire, dismantle and shut down as he saw fit. And even if they did, fuck those morons.

This is just what the redhats voted for in order to lower the price of eggs.

See, I was told this was the result of Midwestern Muslims caring too much about a genocide in Palestine. :-/

I think people put too much weight on the idea of Presidential Vote as people lining up to vote on these sweeping socio-economic reforms. They have to recognize it as a much simpler - almost libidinal - endorsement of The Daddy Party versus The Mommy Party. The choice was never about how efficiently one files their income taxes (a big chunk of Republicans want the entire IRS abolished anyway) or whether the Treasury trades in Bitcoin. It was just whether one personally identified with Trump or Harris as personifications of their political Id.

Trump is literally no one’s daddy and you should be IP banned for implying it until you repent of your sins

Avoiding specifics on what he is doing, what the hell is he doing to deserve his compensation at Tesla, SpaceX, and Twitter? He’s too busy in DC.

I think most everyone suspected this, but being a CEO is a part-time job.

The elites long told us they were the hardest-working Americans.

Don’t forget neuralink and boring.

That’s less efficient

It fits in perfectly with the real name: Department of Government Enshitification

Government overreach? They’re the tax people.

And now the government wants to privatize as much of the governments functions as possible. So in their view the government providing a service that private companies can provide is overreach.

P.S. freetaxusa.com Free federal filing and cheap state filing. Best I’ve filed online with after taxact became a shitshow.

The government should do your taxes for you. We will never have nice things, huh?

Not until H&R Block stops lobbying for things to be difficult.

Intuit (TurboTax) is the main culprit here, but yes.

Intuit can get fucked. I remember one time at work (tech firm) they linked to some podcast featuring Intuit and I about threw up.

Fucking scum

Wait, y’all have to pay to file taxes?

In theory, no. In practice, yes, since a lot of people go to places like H&R or buy tax software to do it.

This online version, as I understand it, was a great way for people that had relatively simple taxes to do it without too much hassle.

But assholes like fElon cannot STAND the threat of a good example of government and something that benefits people they deem unworthy. That’s why these dickheads went after the consumer protection bureau, too.

Give leon a break here, he doesn’t pay taxes.

How it works is people calculate what they owe minus their deductions with aditional forms to account for situations that apply to them and then submit the necessary forms but a very large majority of the USA couldnt even be bothered to vote against Trump so clearly they’re too stupid to do their taxes. They file separately for state and federal but the forms are roughly all the same.

People pay to have somebody else do it for them or have a program which goes over things in very simple terms.

All of this despite the federal already knowing what you owe and how much you paid.

A handful of states had a system that allowed people to use a free online simplified process, but not all, as it was still being tested.

Yes, the state always serves capital not people.

I think we might finally have a common demand that we can all agree on. Deport illegal immigrant Elon Musk and confiscate his ill gotten wealth. General strike time?

Deporting seems a bit too nice. I was thinking moreso jailtime for about a couple hundred lifetimes

General Strike doesn’t appear to have any real benefit to us?

There is going to be benefit any time workers take their power back. The signal it would send would echo in every job/salary negotiation for years.

Okay but all the capital and business stays in the same hands even if people stop working for a few days.

What power do we gain? Who exactly are we trying to hurt with this?

A general strike is not a wage negotiation tactic, its asking everyone everywhere to strike. Theres no general union to present our demands. There is no company policy it opposes.

Yes, general strikes work differently. If people managed to unify to grind the system to a halt for a few days, I guarantee it would scare the fuck out of the capital class. As long as the people arev divided, they have all the power, but it’s an illusion. The moment the people unite, their power vanishes.

The only criteria that matters for choosing a demand for a general strike is that enough people get behind it. That, and it should be concrete enough to show capitulation on the part of capital. There are clearly a lot of Americans who are fine with increasing their own suffering, as long as it hurts someone else more.

It’s so nice for Musk to think of the TurboTax and HR Block shareholders.

/s

I already got my direct file in and it says I should get the return soon so uh, here’s hoping

Damn, I used it last year and it was great

Read the summary.

Just a thought that this brings up. If you are in the USA and you procrastinate on filing your tax return until the last minute, don’t do that this year. Get the return done and filed as soon as you can. We all know is not the fastest system to get a tax return (which many get and depend on), but with musk and trump dismantling the government before our eyes, some or all of those system may be dismantled or collateral damage. This means you may not get you return until much much later than you expect (and need). Getting your taxes filed early gives us the best chance to still get our return processed before this part of government stops functioning as it does today.

Nah, I think its time to collectively refuse to pay taxes. What’s the point in paying taxes to a fascist intent on destroying the country and selling it for parts. They no longer represent the people, more now than ever before.

Nah, I think its time to collectively refuse to pay taxes.

Lots of us are owed money by the government. If we refuse to file the return, that helps the government.

Conversely, if you owe, stall stall stall, file for an extension and stall some more. (This is not tax advice, make sure there are no penalties etc etc.)

But I should procrastinate paying my taxes until the last minute, yes? I have 1099 income that doesn’t have taxes pre deducted from it, there’s I always have to pay in (which is fine, I budget for it)

Did mine the same day i got my w2. Takes like 30 minutes using freetaxusa

Why would you want your taxes done early? That makes absolutely no sense.

If you expect a refund, you have been doing your taxes wrong. Stop taking exemptions. You always want to owe under $1,000. Refund money is free money you lent the government that pays 0%.

If you owe money, you have even less reason to pay taxes early.

Why would you want your taxes done early? That makes absolutely no sense.

I just explained why it made sense. I want my money back before the government functions suffer from Musk and trump.

If you expect a refund, you have been doing your taxes wrong. Stop taking exemptions. You always want to owe under $1,000. Refund money is free money you lent the government that pays 0%.

Listen, I know you’ve got a tiny bit of conventional wisdom and need to share it, but understand that one-size-fits-all doesn’t actually fit-all. When you don’t consider things like this, you come off as not only wrong but arrogant because you’are so confident in your wrongness you’re prescribing action when you don’t even know the situation.

I am getting a refund because I installed solar panels on my house and there are tax credits in the Inflation Reduction Act that give me money back as in the form of credits against the tax I owe.

That you are getting solar tax credits doesn’t change that you could have and should in the future adjust your withholdings. You knew you were going to get money back months ago but didn’t change your withholdings.

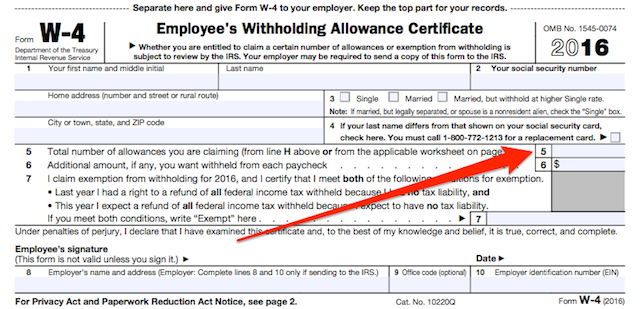

I don’t even know what adjust your withholdings mean. America purposely keeps us stupid. Never have I been offered tax schooling or any thing once.

I don’t even know what adjust your withholdings mean. America purposely keeps us stupid.

If you have an employer, you have money taking out of your paycheck every pay period to eventually go to pay your income taxes on your earnings. This money taken from you for taxes is withheld from you. This is why its called your “withholdings”. Even though money is taken out of your check at regular intervals, you’re not actually paying any income tax until you file your return next year.

You have some control over how much money is withheld from your paycheck. In a perfect world, you would adjust your withholdings so that the exact amount of money taken out (withheld) from each of your paychecks adds up to your total income tax burden for the year. You make these adjustments on the IRS W-4 document with your employer:

If you know exactly how much money you’re going to make that year, and you know exactly how many tax deductions, write offs, write downs, credits, and prior payments you will have, you can set your withholdings to perfectly match how much you owe. This means when you file, you’ll get $0 back, but also owe $0. However, there are penalties and fines if you grossly miscalculate and withhold too little. It also makes you more of a target for audit by the IRS in the years ahead.

For many of us knowing exactly what our tax burden is going to be more than a year from now is near impossible. For some that have not tax benefits and a steady fixed income, its much easier to calculate. I fall into the former category making it next to impossible for me to guess correctly.

Never have I been offered tax schooling or any thing once.

I did get some education on this in my public high school, but didn’t understand much of it when it was explained. It took me years of growing up in the working world to get the hang of it.

Thank you so much for the insightful post. This helped a lot.

You knew you were going to get money back months ago but didn’t change your withholdings.

Yes but how much? Was the project sure to have gone forward? Would there have been overruns? Have you not done project management before? Do you think its realistic to have perfect budgetary projections a year before even talking to a vendor?

The amount was fixed by the contract you signed. You knew what the tax credit was going to be because the salesman likely highlighted it as part of the sale. If you did it yourself, you’d have an every more detailed knowledge of the costs and timeline. Unless it was finished in December, you could have adjusted your withholdings.

I’ve done everything from $100 repairs on my house, $80k renovations, to multi million dollar business deals. Even the bat specialist who moved the bats out of my front required a contract.

It is completely absurd that you had an extremely unique tax situation ( tax credits on a project ending in December so no withholding adjustments could be made) yet your first post was authoritative general tax advice without mentioning it was specific to your condition. Then you had the nerve to call me out for giving general advice.

Are you saying you’re submitting a new W-4 to your employer for even a withholding change that would benefit you for as little as $100? And multiples of them a year as your tax burden changes?

Sounds like Leon owns some tax-filing app shares.

Is this summary AI generated, it’s garbage and seems to contradict the linked article, which is about the same length. The way it’s phrased makes it sound like the free tax filing is still offered, only with customer support now, and no online component. The article makes no mention of this.