If you’re rich, this is good and noble accounting. If you’re poor, this is tax evasion.

You have to have enough income and deductible expenditures to where your itemized deductions would be greater than the standard deduction of $24K, which will not be the case for the overwhelming majority of people

Even so. Doing well for themselves middle class American: tax evasion. The rich: well they’re just really smart business people and we should worship them!

Since the business finances are separate from the individuals/family they would have to pay the business with their personal funds, basically just paying taxes on all of their income twice.

The rich definitely do not do that

If I were an IRS agent, I’d just hang out on these forums and start sending people catfishing messages.

An IRS agent like you will lose your job on Jan 20

I know, but they’ve had so much time to do it.

There’ll be plenty of work for IRS agents in running punitive audits of people and companies in the Emperor’s disfavour.

Sometimes I give them silly advice. Not anything that would actually cause a problem, but just saying they need to find a certain stamp for the document to be valid or whatever.

The problem is that these people have no way to pay their back taxes except rusted out old trucks and dilapidated huts. Then our billionaire overlords get away with murder even more despite actually having the resources to pay for their shit since it’s another is agent not working the big, difficult case.

That’s simply not true. Most SovCits are not impoverished like that. If they were, they wouldn’t spend thousands of dollars to find the cheat code out of paying child support.

Step 1: Use credit card.

Step 2: Get a loan to pay the credit card off.

Step 3: Get another loan to pay that one off.

Step 4: Get another credit card.

I know a guy (independent contractor) who formed a 1-man corporation and paid himself out of it as an employee. Saved a ton on taxes.

It’s pretty common to form an LLC for your own, self run business even at one person. The business makes all the money, you pay your “employee” (you) a small amount and you save on taxes. Wife does this, her employee paycheck is like $25k/year.

If you ever have a friend who’s not doing this, tell them to get a good accountant lol

How does this work if you want to take money out? Like give yourself a bonus that’s taxable? I mean legally.

She gets income from two sources: as an employee (“normal” income), and as a business owner. There’s something called an owner’s draw, which essentially lets you take money from the business for personal use, and it gets taxed as personal income (i.e., normal job income taxes).

This is my loose understanding. We have a CPA for our stuff, and she sorted all this out before we even started dating.

Edit: you can also pay yourself dividends from the business, but this is considered supplemental income and can’t be a majority. These dividends are taxed at a lower rate than your income.

That actually sounds really good 👍 Would need to read how this works across the pond, but hoping fairly similar.

I would highly recommend asking an accountants advice, I assume there are similar services for when you file in the UK. Finding a CPA (Chartered Accountant in the UK) is huge, they’ll generally charge more but they can represent you in the event you get audited (had to look it up and confirm it’s the same for UK). Now if you get audited, they have a vested interest in protecting you. In the US they’re often legally obligated to protect you (and themselves).

Thanks, will take a look at that. Actually got an accountant acquaintance so il pick his brain one day :)

This is so dumb I can’t believe people aren’t getting audited left and right.

A single member LLC is simply you. All the income becomes your income. It doesn’t matter if you pay yourself through a draw or not. If you’re finding ways to get your write offs over the standard deduction without spending a bunch on actual business related expenses, you’re probably doing it wrong and committing tax evasion, plain and simple.

Look into piercing the veil.

2017 tax law changed this

One of the law’s changes allowed owners of pass-through businesses—partnerships, sole proprietorships, and S corporations—to deduct 20 percent of their qualified business income (QBI) when calculating their taxes.

Edit: Better source https://www.irs.gov/newsroom/tax-cuts-and-jobs-act-provision-11011-section-199a-qualified-business-income-deduction-faqs

There are still benefits to an LLC if you’re alone. Suggesting that everyone is committing tax fraud is speculative at best. Fun fact, she actually was audited for 2017-2019 because of shit her ex husband did, and no tax fraud (on her part, he was definitely guilty and we successfully argued for Innocent Spouse Relief). You can also pay yourself dividends which are taxed at a lower rate, though the IRS checks this income to make sure you aren’t using this stupidly.

Generally, you’re protected with your assets, piercing the veil can only occur if there’s egregious fraud and clearly no separation between yourself and the business. Just keep your business and personal accounts separate and you’ll have the legal protections.

Edit: I went back and asked her and there’s definitely tax benefits, she files as an s corp and it saves a bunch on taxes. It’s more expensive to file so the income must be over like $70k-$80k to really make it worth it.

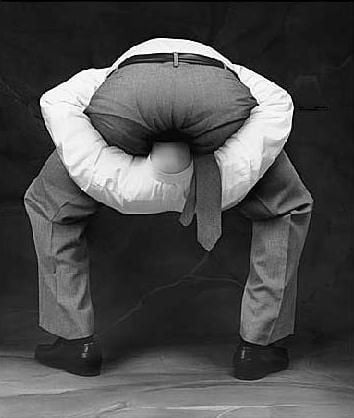

This is like that Seinfeld segment about “writing it off”.

For those not aware, you can typically only write off the taxes you owe to the government, and only in certain situations where that’s allowed.

Once had a guy mention i should rent a bunch of cars then rent them out to make money.

Wouldn’t that ruin your credit? “Hell yeah”

I’m financially illiterate so can someone explain to me if…

-

Would this actually work?

-

If so, I much legal trouble can I get in?

Don’t worry, the people posting those sovcit fever dreams are financially (generally?) illiterate too.

It just hit me what sovcit stands for. Damn. I feel like a dumbass.

-

You see US tax law is so complicated and I know so little about it that I don’t know if this would work or not. I’m guessing somehow not unless you’re rich.

Many business owners that I know do a lite version of this. Going out to eat? Discuss work for 5 minutes, then you can call it a business meeting and avoid paying taxes on the meal. Driving to and from work? Gas is a write off. Buying supplies for the office? Tax free, and maybe some of the supplies make it home with you.

That’s fraud. The 5 minute business discussion can be written off, the remaining (let’s say) 55 minutes cannot. Maybe it differs where you live, but where I do only travel between work destinations can be written off, so home to work doesn’t count. Buying supplies for the office is a normal and valid expense, taking them home is theft and/or taxable

They’re simply talking about what people do and probably usually get away with. I hope no one is reading a comment like that (or yours) on the Internet and then changing how they file their taxes…

Never trust anyone or anything. Trust me.